529 Plan & Information

Guide for Using 529 Plans for K-12 Tuition at GVCS

What is a 529 Plan?

A 529 Plan is an after-tax investment account that grows tax free if distributions are used for qualified educational expenses. Prior to 2018, qualified expenses were limited to those related to college, such as tuition and fees, room and board, and textbooks.

What effect do the recent tax changes have on 529 Plans?

As of January 1, 2018, 529 Plans can now be used to pay for K-12 tuition up to $10,000 per year for each child. This limit does not apply to distributions used for college expenses.

What are the benefits of using a 529 Plan for K-12 tuition?

Similar to years past, when contributing to a state-sponsored 529 Plan in Iowa (i.e. the College Savings Iowa 529 or the IAdvisor 529), each Iowa taxpayer can deduct contributions up to $3,522 per beneficiary on their Iowa tax return in 2022. For example, a couple with two kids could deduct a total of $14,088 if both parents make a contribution to a 529 for each of their children. Due to the new tax changes, this tax deduction can be claimed even if funds from the 529 are used immediately for K-12 tuition.

In addition, investment gains inside of a 529 are not taxed if distributions are used for qualified educational expenses. Consult with a financial advisor before investing.

How does the 529 Plan interact with the Iowa Tuition and Textbook Credit?

The Tuition and Textbook Credit was in place prior to the new changes to 529 Plans, and allows Iowa taxpayers to take a credit of 25% of qualifying K-12 tuition and textbook expenses up to $1,000. The maximum credit amount is $250 per child.

According to guidance issued recently by the Iowa Department of Revenue, expenses that qualify for a tax-free 529 withdrawal can also qualify for the Tuition and Textbook Credit.

How could a GVCS family utilize a 529 to pay tuition?

Here is a hypothetical example:

Joe and Sally have 2 children attending GVCS. Their son George is in 6th grade and their daughter Susie is in 3rd grade. They have a total tuition bill of $15,000 for the year ($8,000 for George and $7,000 for Susie). Joe and Sally contribute to their Iowa 529 accounts on July 16 as shown in the following table:

Since $3,522 is the maximum contribution that can be deducted from their Iowa tax return, Joe and Sally do not exceed this limit for their contributions for George. By each contributing $3,500 for Susie, Joe and Sally can contribute her entire tuition bill.

On July 26, Joe and Sally request distributions for the same amount as their earlier contributions to help pay their GVCS tuition bill.

The total distributions for each child are under the $10,000 limit for K-12 expenses. In total, Joe and Sally are able to use $14,044 from their 529 accounts toward their $15,000 tuition bill.

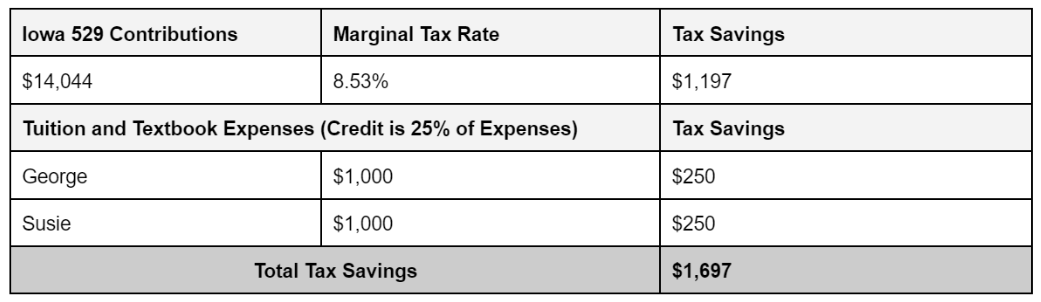

The table below summarizes the total tax savings for Joe and Sally on their Iowa tax return. In addition to the deduction for the 529 contributions, Joe and Sally are also still able to take advantage of the Tuition and Textbook Credit of $250 per child.

This is only an example. Please consult a tax professional to calculate potential tax savings.

What are some additional considerations when using a 529?

If distributions from an Iowa state-sponsored 529 are used for K-12 tuition, the student must be attending an accredited private or religious school in the state of Iowa in order for the distribution to be qualified. When using funds from a 529 for college, the eligible schools are not restricted to the state of Iowa.

529 withdrawals can be deposited into the parent’s bank account or paid directly to the school or institution. Refer to the 529 Plan for specific requirements.

Be sure to allow processing time when requesting a distribution. In addition, contributions to a 529 are subject to a 5 to 7 business day hold before that contribution can be withdrawn. However, there is no restriction on how soon a contribution can be made after a withdrawal.

Qualified distributions from a 529 must occur in the same calendar year as the corresponding expenses in order to avoid taxes and penalties. However, those distributions can be made at any time during that calendar year.

Contributions to a 529 do not have to be made the same year as the corresponding expenses. If a family with a newborn decided to begin saving for their child to attend a private school, those parents could start contributing immediately and receive a tax deduction on their Iowa tax return in the year of the contributions and also potentially benefit from more tax-free growth.

If a family is already contributing to 529 accounts to save for their children’s college, it may not be advantageous to use 529 funds for K-12 tuition. Consult a financial advisor for help with college planning.

More Questions?

Contact Justena Fletchall at jmfletchall@gmail.com or (515) 290-0837.